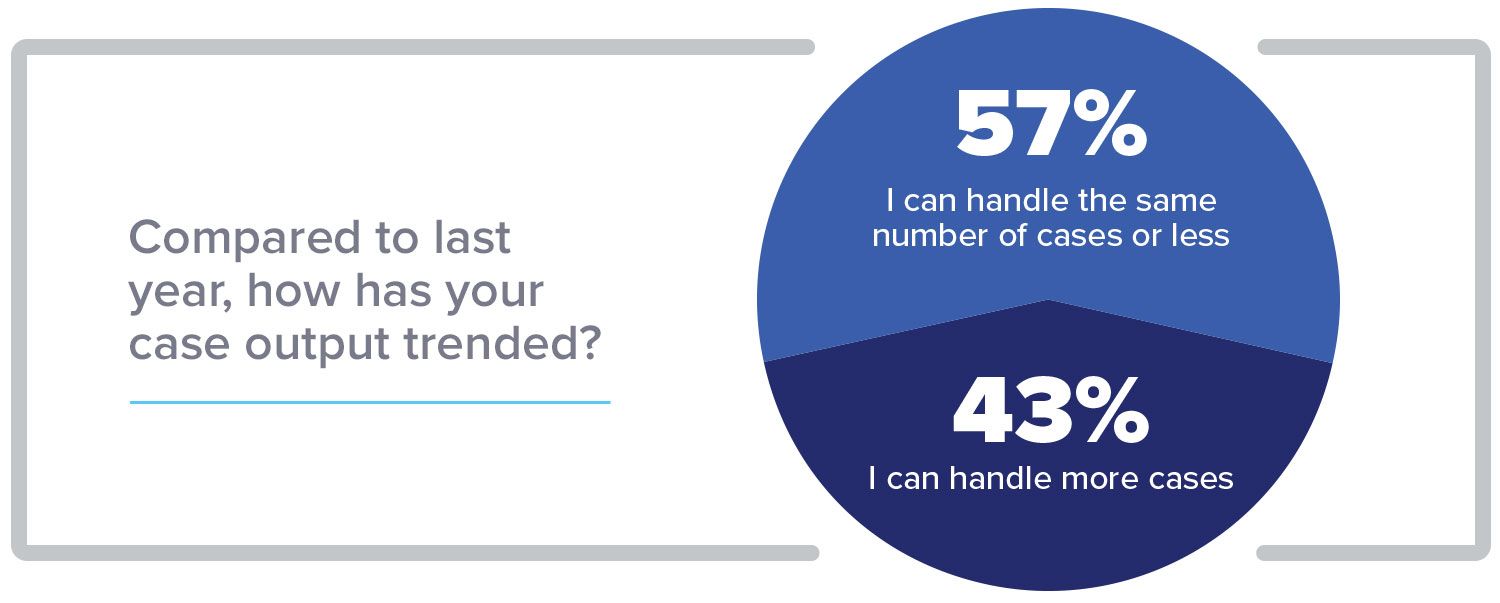

The 2020 Global Financial Crime Investigations Survey: 57% of analysts saw productivity stagnate or decline, introducing business and cyber risks to firms.

Today, Authentic8 released a new report based on findings of its 2020 Global Financial Crime Investigations Survey conducted with ACFCS. The survey encompassed more than 150 organizations and set out to understand how their financial crime investigation practices are faring. Unfortunately, the answer is, “not great.”

Against growing threats in the financial crime space, 57 percent of survey respondents reported stagnation or a decrease in caseload productivity over the last year. If investigators are unable to keep pace with threats, their organizations risk monetary loss, compliance violations and exposure to adversaries.

“Adversaries are growing in both sophistication and number, but the surveyed firms are telling us the productivity of their fraud analysts is not improving at the same rate. The imbalance leads to more risk exposure for financial firms and other regulated industries. They risk write-downs, legal penalties, damage to their brand reputations, and more. What this survey is telling us is that companies need to focus more resources on the productivity of their financial fraud analysts, and specifically on the investigation tools that their analysts need in order to be effective in their research.”

Scott Petry, Authentic8 CEO and Co-Founder

Other survey responses uncovered what could be causing productivity issues in financial crime investigations.

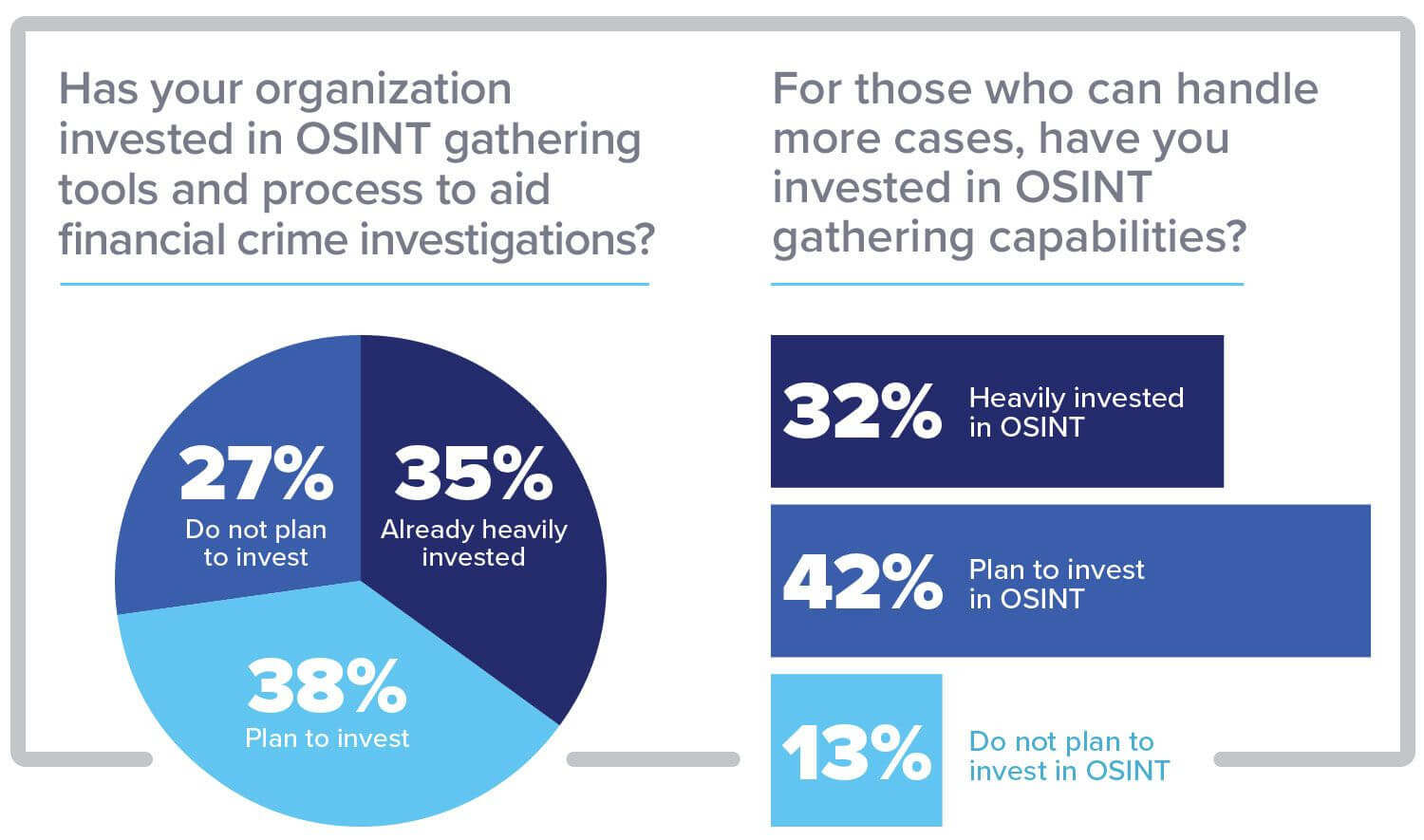

Of the 43 percent of survey respondents who have seen productivity go up, 86 percent have already invested in open source intelligence (OSINT) gathering capabilities or will be investing in it; of all survey respondents, 90 percent indicate that more investment is needed in this space to accelerate time-to-insight for investigations. It seems productivity critically hinges on enabling effective OSINT gathering.

To learn more about these and other findings from the survey, download the 2020 Global Financial Crime Investigations Survey Report here. In addition to survey statistics, the report also includes insights on how to make the right investment in people, processes and tools to overcome the productivity challenge.